2020 First Home Buyer no LMI Government Scheme

What is the First Home Buyer no LMI Government Scheme? In 2019 the Liberal Government announced a Scheme to support first home buyers as part of their election campaign. Since winning...

Let us be your Property and Finance lifeguards and step you through the Property Loans Process with our team of experienced Mortgage Brokers, Buyers Agents & Financial Planners.

Cost-effective solutions for new Home Loans, Refinancing, Consolidating Debt, Commercial Property & SMSF Property.

Apply for Finance

Our Mortgage Brokers obtain Business loan finance from $50,000 for a startup through to $10,000,000 loans or more.

Business Loan Options

We review your current financial position, determine your financial goals and checklist how to achieve those goals.

Get Financial Advice

Fordable has committed to Pledge 1% of the revenue received from home loan settlements towards two Ocean Conservation charities who are doing the job that we cannot. Those charities are Sea Shepherd and Great Barrier Reef Legacy.

Read moreA buyers agent is one of the best service providers to have on your team. They not only know the market inside and out, but they are always on the hunt for the best deals which they can put you in front of.

Using a Buyers AgentThere are many considerations when buying property, such as home loan products, having a Mortgage Broker to offer multiple products and the applicaiton process.

Check out our home loan products page to understand what's available.

Learn the 10 steps to the Property Buying Process and how to ensure your finance is in order.

Connect with our Mortgage Broking team to learn how to get a Home Loan and what is required to complete a successful home loan application.

What is the First Home Buyer no LMI Government Scheme? In 2019 the Liberal Government announced a Scheme to support first home buyers as part of their election campaign. Since winning...

What is a deposit bond?If you are struggling to get access to a 10% cash deposit for your property purchase, you’re not alone!Whether you’re a first home buyer, downsizing or...

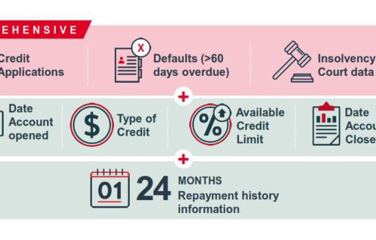

What is Comprehensive Credit Reporting (CCR)?Comprehensive credit reporting (CCR) permits the collection of specific consumer credit information so that it can be used by credit providers when making a lending...

How much can you afford to repay and still have a great family lifestyle?

Use our Loan Repayment and Mortgage Calculator to help you manage and plan for future repayments of your home or investment.

Purchase a Residential Investment Property or a Commercial Investment Property through your SMSF.

Using your SMSFUse an Investment Loan to improve your financial wealth with a range of Interest Only products available.

About Investment LoansChoose from a Chattel Mortgage or Novated Leases for Vehicles or Asset Lease for your Business.

Equipment & Asset ProductsBest Home Loans with affordable options and rates from Australia's most trusted Banks and Lenders.

Learn about Home LoansLoans used for business or investment with negotiable terms based on the loan to value ratio.

Commerical Loan OptionsGet finance for new Equipment or Assets, Inventory, an Overdraft, Line of Credit or Term Loan.

Finance Options