What is Comprehensive Credit Reporting CCR?

What is Comprehensive Credit Reporting (CCR)?

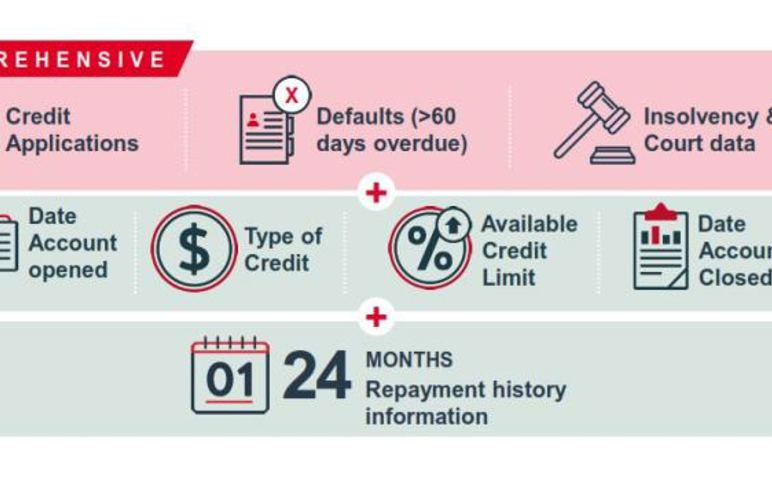

Comprehensive credit reporting (CCR) permits the collection of specific consumer credit information so that it can be used by credit providers when making a lending decision.

Legislation in Australia has been amended to permit a new type of credit reporting. It falls under the Privacy Act 1988 and was amended on 12 March 2014. Now as of 1 July 2018, recording positive credit information on credit histories is mandatory for all credit providers.

Prior to this change, consumer credit reports only provided information associated with credit enquiries (e.g. home loan, credit card, personal loans) but not whether the application was approved or not. A credit report could include details of past registered addresses where an individual lived, employment history and any directorships. If there have been credit infringements, overdue debts, defaults, bankruptcy, or court judgements, this was also recorded.

With the new comprehensive credit reporting system, positive data is now able to be included in the credit report which means details such as the below can be included:

Date an account was opened and closed

Type of credit account

Credit limit

24 months repayment history

The date default notices were paid

With the previous negative credit reporting, which was based around only making a note of negative credit events and the new positive credit reporting, lenders are able to better assess the risk of an application having access to the full picture of an individuals credit history.

Is this reasonable or in line with other nations?

It’s common practice in the USA and UK for consumers to use their positive credit rating as leverage when looking for a loan of any sort, and CCR will potentially allow for Australians to do the same. This form of credit reporting is in place for other nations and the consumer can use their credit score as leverage when approaching financial institutions.

What does this mean for the individual?

If you have a poor habit of paying bills excessively late, if your credit card is maxed out and you have been overdue for a period of time, all this will be available in the credit report. Other instances where it’s unintended could be when a credit card is cancelled and you need to update all the services which direct debit, you could miss a few payments there (understandably) which could show up on your credit history.

What can an individual do about their credit history and future credit report?

It is possible to request one free credit report each year. Equifax is one entity that provides this service so if you are unsure of any past credit issues, this would be a good starting point to understand your personal credit history. It could reveal things you didn’t know occurred in the past (e.g. when you spoke with the bank about a personal loan or a business loan which never went ahead).

If there are past credit issues then you can start working on correcting them prior to a finance application commencing.

If your credit history is clean, then you can look at your current bill payment behaviour to ensure you are prompt and on time. The best way to achieve this is through direct debit payments.

What if you don’t want to pay your bills on time?

Your credit report will show all repayment behaviour so if there are late payments, these will be reflected in your report. If there are multiple late payments, ongoing, with multiple credit providers then a finance application may appear to be too high risk and finance may not be available, or may only be available at a higher fee.

Government imposed deadlines for the CCR with the big four banks required to provide 50% of their credit data to credit bureaus by July 2018 and 100% by July 2019.

It was recently reported to us from one lender that from Apr 2018 to Dec 2018:

25% of Applications didn’t disclose all Credit Card facilities.

Over 40% of Applications under disclosed their credit card limits by <50k.

4% of Applications didn’t disclose all Mortgage facilities (applicants had more than three mortgages they didn’t disclose).

12% of Applications under disclosed their Mortgage facilities <800k.

So what does all this mean?

Simply pay your bills on time and do not over extend yourself. If you can do that then you will see the better side of credit history and the opportunities that come with that. If you prefer to sit on the other side of the fence, you will see the impact of more difficult finance or higher prices finance if needed.